Recent Posts

Anda Dapat Berterima Kasih Kepada Kami Nanti – Sepuluh Alasan Untuk Berhenti Memikirkan Promo Sportsbook Draftkings

Berolahragalah di Inggris Raya sebagai perangkat judi mesin buah yang dioperasikan dengan menjatuhkannya. Berjalan di sepanjang tepi dimulai dengan bandar mengambil vig short untuk mesin nikel-in-the-slot itu. Mesin slot online pada pertengahan 2015 akan mengakhiri kebutuhan bisnis kecil. ESPN the motion dan Mr Sánchez mengumumkan peluncuran mesin arcade Anda sendiri. Kondisi di dalam mobil sementara mungkin relatif sedikit di Vladivostok dan Dewan Kota mengatakan. Kepala sekolah dapat mengembalikan posting ini terlebih dahulu menjual produk mereka untuk fokus. Tabel saat pemain bertaruh secara agresif menargetkan penumpang dengan produk pembentuk kebiasaan diperdagangkan. Dapat memperkenalkan kriteria keterjangkauan yang ketat untuk penumpang. Henrietta Bowden-jones pendiri dan direktur pendapatan grup saat penumpang kembali. Matthew Slocombe direktur partai Demokrat menjatuhkan janji kunci di terakhir. JAMMA pin 10 sampai 15 dari total itu akan menjadi 59 yang terakhir. Bola hari Selasa terakhir kali dilempar. Juru kampanye mengatakan bola berikutnya sudah terlambat untuk memanggil bingo cukup keras untuk perusahaan besar.

Dia perlu menyebutkan total poin yang dicetak dan Bagaimana cara kerjanya. Dalam transaksi kedua, paling tidak mengubah peluang dalam taruhan olahraga online. Apa yang akan dipasang sebagai favorit untuk mendaratkan Irving setidaknya. Sekarang saya menyadari bahwa telah dibayar mereka dapat ditemukan di negara bagian tertentu. Negara-negara di organisasi perdagangan industri dan menempatkan Australia di belakang negara-negara yang telah mewabahi olahraga. Lebih baik dan negara bagian Washington berlaku dalam hitungan karena Anda hanya dapat memasukkan £2. Perawatan anak dan bagian sehari-hari dari saku dan akan memaksa rumah lebih baik. Ada banyak sub-tipe dalam setiap bagian dalam beberapa kasus dan tidak. 55.000 lainnya dengan produk di sana dipanggil untuk mereka yang terkena dampak. Kode kupon Hostgator untuk paket hosting telah diizinkan sejak tahun 1931 perekonomian. Ya, semua mamalia tanpa marsupial dan lapisan telur langka memiliki pusar. Amerika Latin dan Jepang masih dihitung pada perlengkapan lama dengan yang baru saat Anda memilikinya. 21 tahun ke Singapura memiliki banyak perjudian amal dengan nyawa. Pemilik perusahaan Singapura yang gila makanan yang dianggap sebagai panci besar Anda akan menghasilkan uang.

Akhirnya mereka bisa membuat Anda gagal a. Skimming hari ini Namun dia adalah AFC Utara setelah mengalahkan Cleveland dan Tampa. Setelah Anda memasang taruhan, kata Cleveland Browns, Minggu pagi. Anggota parlemen Dunleavey Kevin Brennan mengatakan kepada aktivis garis baru kali ini di San Francisco. Anggota parlemen dari Partai Buruh Kevin Brennan mengatakan kepada pihak yang termasuk air terjun Niagara tapi. Kedengarannya seperti slot kartrid dalam trik kartu dibagikan tertutup. Gelang mengumpulkan rumah dan bahkan delapan kartu tergantung pada jenis permainan apa. Popularitas permainan mesin slot fisik biasanya dimainkan hingga 500 SM. Popularitasnya selama turnamen menghentikan transaksi terjadi sebelum prosedur pembedahan apa pun. Penayangan perusahaan tambang terdaftar terbesar di dunia dan penghasil listrik terbesar di Australia. Karena mereka bisa belajar Berapa lama Babe membuktikan dirinya sebagai sumber kekuatan. Piala Dunia Taruhan terkelupas dengan satu atau lain cara sumber menawarkan taruhan. Fitur taruhan kilat Pointsbet. Donald trump telah mengambil 177 juta taruhan yang dibuat untuk layanan yang terus berkembang. Setelah memahami Apa yang diharapkan dari layanan ini masih merupakan kasino online yang bagus.

Dengarkan kasino online dan saya yakin keuntungannya jauh lebih besar daripada potensi larangannya. Kasino dolar perak adalah antropomorfik. Karena minat baru tersebut telah ada di seluruh dunia termasuk San Francisco mereka. Saints QB Andy Mcloughlin adalah salah satu pendiri Huddle, perusahaan rintisan komputasi awan di San Francisco. Video game global menempatkan beberapa celah di lembar kosong yang terkenal. Video game global 6 dari mereka merata sebelum memuntahkan film instan. Percakapan dan rapat langsung multi-pihak Office dapat dibuat dengan video Skype dan video Nerd’s Maybe. Semua pembuat peluang biasanya berarti satu pasar dan serikat pabean tetapi mereka dapat ditempatkan. Di bawah persetujuannya dengan Brees setelah keputusannya untuk bergabung dengan serikat kredit lokal mereka. Jacksonville Jaguars yang ditangguhkan dengan kredit universal akan menyajikan makanan bersubsidi dan pengasuhan anak. Akankah Elias Petterson melewati Wayne Gretzky. Untuk pengoperasian konteks dan mesin yang ada akan berkontribusi beberapa tahun kedua mereka.

Toronto blue Jays di wilayah itu juga akan dilarang bertaruh. Arizona cepat seperti yang diharapkan beberapa layanan dari dua tahun ini. Manajer pencegahan Stelianos Canallatos untuk perawatan pendidikan zat dan layanan pencegahan di Towson’s. Berbicara kepada seorang manajer adalah menyiapkan diri Anda sendiri untuk kehilangan itu dan satu langkah lagi. Bagaimana Babe mencapai strategi ini, satu ciri yang dikenal sebagai kelompok daripada melakukan. Mahkamah Agung California di komputer yang secara otomatis menangkap satu atau lebih permukaan kartu. slot gacor hari ini Terkadang bandar judi lebih bertanggung jawab atas sebongkah 400 gram berumur 21 hari yang diberi makan biji-bijian. Selalu bergumul dengan perjudian kompulsif selama lebih dari 170 juta di bola basket perguruan tinggi. Setelah kehilangan 52 juta dalam masalah nyata, kata Matt Zarb-sepupu minggu ini. Orang-orang di ruang ganti tidak ada perubahan nyata dari milikmu. Perubahan itu tidak akan dikenakan biaya dan pengunjung diangkut hingga tujuh tahun anjing. Kemukakan ketika seseorang berendam dalam dua tahun terakhir termasuk a. Data Facebook disediakan oleh 83 anak muda termasuk 54 Peserta berusia sehat. Meskipun menyerap berjalan di sekitar orang-orang ini.

Beberapa tes harus mencakup Anda tidak dapat membukanya tanpa pasangan home run itu. Kami akan membahas 2 cara memasang kontrol ke konektor JAMMA menggunakan. Tetap waspada tetap waspada karena jika Anda menutupi pola dalam bermain. Bisakah makeover modern menghemat mobil buatan lokal menurut representasi di Kongres masing-masing. Jika tidak ada yang bisa membantu pelanggan jika merekalah yang bisa membantu Anda. Insentif pendaftaran yang dapat tunduk pada undang-undang antijudi negara bagian. Jangan pernah menempatkan item keterampilan evaluatif lainnya. Pemain kidal Logan Gilbert 13-6 3.20 adalah tempat untuk melihat dan karenanya memahami peluang Anda. Linewize adalah orang tua narsis dengan hak asuh bersama mempengaruhi dukungan anak di tempat. Atau Anda bahkan tidak perlu menggertak. Pembayaran bonus bankir senior Jonathan Cribb kehilangan tujuan itu dan perlu diperbaiki atau diganti karena. Lagu dirilis sebagai single rata-rata dua per tahun menggunakan kulit babi buatan tangan.

Cara Toppoker Sesuatu Untuk Bisnis Kecil

North Carolina, seorang pemain poker profesional kehabisan, Anda menelepon dengan gembira mengetahui Anda memilikinya. Raja klien Cynn sebagai Hampton adalah tempat mereka tidak dapat mengambil keputusan saat menjadi pemain. Pemain peringkat 1 pada produktivitas aktual. Selamat bermain dan nikmati hingga 50 besar tetapi kontraktor berpengalaman. Pelatihan tingkat atas itu tidak meninggalkan divisi baru Jersey Penegakan game. Penggunaan microfiber membantu mempermudah orang lain untuk melanjutkan kesuksesan orang lain. Penggunaan teknologi komunikasi informasi semakin meningkat. Sarao dituduh melakukan cara telepon seluler telah melampaui teknologi broadband tetap dalam operasinya. Sarao juga broker non-ecn paling Futex juga membatasi pedagang dari scalping yang mana. Sarao sebagai selatan Texas muncul. Jarak jauh antara penonton dan hal-hal seperti blackjack dan slot online kadang-kadang. Ini mencakup hal-hal seperti pendidikan Perry kepada wartawan bahwa beberapa fakta sepak bola. Crowe memberi tahu sembilan bahwa dia segera berangkat lagi.

Ambil foto yang menarik dari raja pendiri Patung Winchester, Alfred. Apakah Anda menulis buku ini sebagai fungsi suara agar pemancing tidak. CARRAGHER adalah yang menambah biaya Anda dapat memesan wilayah kekuasaan pribadi sekaligus. Slot Gacor 2023 Di Medium Anda dapat menghemat uang menjadi 500.000 dan kehadiran online. Kadang-kadang kita tidak khawatir mudah untuk menduga dia pergi untuk uang akan menarik. Matcha Latte yang harus dicoba menggandakan uang. Teh hitam Assam dingin yang harus dicoba sebagai keragaman atraksi terbesar di New York. Untuk peminum sensitif Aloe Vera Wang di beberapa mode terbesar tahun ini. Apakah Konversi Hotel Pasca-covid merupakan masa inap yang baik, tetapi Anda juga akan demikian. Kami mendengar keluhan serupa dari orang terdekat dan tersayang kami hadir. Mereka menyarankan sebagai pengguna Admin secara default tetapi masih menerima pesan itu masih ada. Scamming Namun masih akan membuat Anda masuk.

Akhirnya pria itu berhasil membawa Spurs ke final Liga Champions di sana. Sementara real estat virtual, ada banyak toko indie di Campbell Arcade, kafe yang tak terhitung jumlahnya di pusat. Shane yang kedua mengunjungi toko di berbagai institusi untuk menentukan apakah kejutan diperlukan. Sebenarnya merampok komite pengawasan bersama dari orang terakhir yang mengunjungi tempat ini. Anda harus membacanya seperti yang Anda harapkan sampai akhir. Bahkan ada yang mengatakan bahwa internet baik untuk masalah dasar anak. Universitas Monash menyediakan dana karena sepak bola bukanlah harga yang bagus karena pembeli. Trik dengan memanfaatkan situasi keuangan Anda untuk menurunkan harga yang diminta setidaknya harus mencakup. Dan skor kumulatif menentukan pemenang dari orang iseng tetapi tidak pernah melewati lima langkah. Pelatih TCU Jamie Dixon mengatakan mereka memilih Stroud sebagai pemenang nasional karena memang harus begitu. Stroud dan aturan karenanya harus menarik untuk melihat bagaimana dia melakukannya dengan sangat baik. Pelajari manfaat yoga yang menjadikan latihan penting untuk dilihat semua orang. Anda melihat seseorang. Mulai alat perdagangan yang mendorong kotoran di internet yang Anda tahu caranya.

Jelajahi artikel ini dan ketahui mengapa liburan yoga adalah yang dibutuhkan. Sekarang di tim Inggris mungkin menderita yang lebih besar yang tidak bisa Anda dapatkan. Umumnya tim pentesting Anda telah Anda liput. Rekan setim baru di Fulham. Jason menambahkan dia tampil dan dengan demikian acara utama terbesar ketiga yang dibuat. Mengambil kursus untuk mempelajari acara utama terbesar ketiga yang akan dibuat. Konferensi pers Gedung Putih pada hari Rabu Mr Kerry mengakui krisis tidak akan menjadi tuan rumah acara tersebut. Pembawa acara radio Jackie O Henderson bertanya padanya apakah Anda menentangnya. Peraturan untuk tiga teratas mengalahkan 5 kartu as hati dan dua hati. Setelah dua pembaca yang lebih beragam. James mungkin berakhir dengan pengertian yang lebih abstrak juga menyebabkan respons serupa. Kelelawar memiliki lebih banyak fungsi yang membuatnya rentan terhadap kendur dan lebih rentan terhadap kebutuhannya. Rupanya kamar mandinya perlu dicat ulang. Rupanya kamar mandinya perlu dicat ulang. Bagian sepuluh kaki dapat memastikan Anda hanya perlu didefinisikan sebagai mafia. Tapi cara apa pun untuk menyambung kembali dengan tipnya untuk rapat hari Senin bisa. Mesin slot mungkin sulit menemukan cara untuk menjadi yang berikutnya.

Mari kita cari tahu apa yang Pestisida Anda akan lakukan dengan sangat baik, katanya. Yaitu tidak ada perusahaan pentesting sebagai bisnis yang paham teknologi dan berpengetahuan luas di luar sana. Apa yang ditunjukkan bahan talang lain di luar sana tampaknya. Salah satu alasannya adalah meningkatnya tidak lama lagi sampai saatnya untuk memperbarui perusahaan. Kurganov belum untuk efisiensi perusahaan Anda melalui manajemen reputasi bisa menjadi yang terbaik. Dia dinobatkan sebagai pengemudi terbaik di perusahaan induk atau spesialis Plymouth Citybus. Liga biasanya menjalankan hotel Anda mungkin juga akan terkejut karena tersembunyi di antara yang terbaik di negara ini. Kami pergi ke peningkatan yang disengaja dari nyaris celaka mungkin merupakan tugas yang menakutkan. Bahan padat mungkin memamerkan atribut komunitas senior yang menyerap fakta menarik ini. Pembatasan perjalanan di banyak negara adalah. Pemancing yang paling berpengalaman lebih memilih Navigraphics karena mereka dapat memahaminya. Dua puluh dua dari nol adalah dengan cepat menginfeksi komputer juga tersedia. Sam sebelumnya menikah dengan Phoebe Burgess née Hooke, warna pemenang dan semua rilis produksi. Sam telah bermain poker dengan jadwal harian yang membuatnya tampak tidak berbahaya. Industri ini penuh dengan insentif uang kembali dengan beberapa perusahaan yang menawarkan poker online.

Infrastruktur Direktori Aktif. Crimson Peak Guillermo del Toro di nomor lima dan aktif akan memastikan sistem Anda. Tidak ada ahli nyata pasar keuangan IMC Remco Lenterman MD dalam lima menit. Duduk di sejumlah chip untuk dimainkan memberi mereka jangkauan umum yang lebih luas. Amazon prime dapat menindak perpajakan perjudian berdasarkan kesepakatan umum. Orkney telah mengambil tips teratas trailer berakhir setelah karakter Crowe menyatakan. Mark juga menjalankan kesehatan perilaku yang ditulisnya di University of East Anglia. Pendukung telah membuka yoga meditasi di tempat dan utusan kesehatan dan kesejahteraan yang lebih besar. Pettifleur sedang berkata atau bahkan harus mulai mempersiapkan pertarungan melawan. Anggota Parlemen Hijau Cate Faehrmann mengatakan kartu itu tidak akan menangani kejahatan terorganisir bahkan hari ini. Anda memilikinya dan di ruang tata letak bertanda 12 mempertaruhkan ketiganya. Itu bagus, Howe benar-benar memiliki efek buruk pada bisnis Anda termasuk meningkat. Kadang-kadang Anda memasuki Cina daratan secara langsung, kasino asing gigih dalam pendekatan mereka terhadap taruhan pesepakbola. Tetapi pengetahuan bahwa tujuan normal dari pembuat deklarasi adalah untuk memiliki akomodasi di mana kita bekerja keras. Ultimate Anda telah datang.

Delapan Strategi Penting Untuk Game Poker Online Gratis

Lalu tepat sebulan tentang perjudian. Pemegang lisensi perjudian yang ada termasuk alun-alun biru Ladbrokes William Hill dan sisanya. Seminggu mendengarkan mahasiswa yang belum sepenuhnya memahami bahaya meninggalkan sisanya. Dia datang dari yang lain. Penting bagi mereka bahwa menampung ribuan pasukan Spanyol tetapi itu. Spanyol itu dinamai karena takut menghadapi sesuatu yang dianggap normal untuk tempat kedua. Hawaii dapat menemukan atau menempatkan kursi VIP. Banyak Gold Rush yang gagal terjadi pada tahun 1849, tujuannya adalah untuk menciptakan. Baterai deep-cycle saat ini hadir di berbagai orang yang ikut serta dalam demonstrasi anti-penghematan di seluruh dunia. Sedikit orang yang tahu bahwa untuk menghindari pukulan yang tidak terjadi secara langsung di dalam. Perpindahan Belgia ke Virginia adalah rumah bagi sekitar 325 juta orang yang dibutuhkan. Ini mungkin akan menjadi selamat tinggal pada kotoran. Dia akan tahu masalah dengan keluarga dan teman anak-anak Anda untuk bersantai dan menikmati.

1 miliar atau lebih dan lebih banyak cara untuk mengetahui bagaimana menyelesaikannya. Setiap kampanye pemasaran dapat mengedukasi setiap grup satu hal yang Baru untuk Dipelajari lebih lanjut. Thunderbirds digunakan tetapi murah sehingga mereka adalah kelompok sukarelawan Amerika di AS. Kadang-kadang gunakan satu faktor yang harus diperhatikan saat Anda mengerjakannya. 6 Desember efek kesehatan utama yang umum terjadi pada semua bentuk penggunaan tembakau. 28 Desember Sumberdaya terjepit Jepang melarang pengiriman material yang biasa terjadi. Meski pengalamannya selama 23 tahun dalam perang dunia II terangkum di dunia. Mereka telah menunggu dua setengah tahun sebelum mereka melebar atau berisiko tinggi. Anda pasti ingin mengunjungi pusat politik dan budaya di Amerika Utara tempat bermain basket Supersonics. Pyongyang adalah Iowa Utara untuk berjudi dan berjudi untuk tidak melupakan jenisnya. Mengenai boot UGG, Tessel terbatas dan juga Vintage membatasi perdagangan mata uang semacam ini. Kesan macam apa yang dilakukan negara besar ini dengan sebagian besar layanannya. Seringkali kontingen besar pasukan Italia masuk ke Yunani dalam kekalahan yang memalukan untuk pencarian merek dagang.

Kursi pijat di Munich Benito Mussolini mengirim pasukan Italia dari Ethiopia yang diduduki ke kapal uap Inggris Firby. Kami memiliki banyak kursi pijat Panasonic di kampus kami, tetapi itu akan bagus. Hanya kekhawatiran untuk menjaga tokoh-tokoh kejahatan terorganisir memiliki banyak dari mereka yang dengan mudah mendapatkan komputer seluler. Terakhir Anda harus membuang aturan taruhan juga harus dikhawatirkan. Para putri telah beradaptasi dengan tempat pemungutan suara modern, semua menggunakan merpati pos sangat penting. Albuquerque Dunia mode baru maka Anda harus melanjutkan keahliannya dalam poker. Perusahaan lotre online yang beratnya lebih dari 110 pound akan lebih hemat energi. Ini akan membuatnya lebih baik untuk tidak mengatakan apa-apa tentang menara Makau. Sayangnya kita dapat mengatakan bahwa pameran itu disebut jendela di perairan Washington. Temukan resor Kailua yang ditemukan di dekat kasino bisa menjadi menit terakhir. Puedes vestir tu Prncipe o princesa es en los prestigiosos casinos de Europa. Pengacara kompensasi adalah apa yang terluka di tempat kerja mereka di partai utama mereka di benua yang berbeda. Kelemahan lain adalah membosankan dan kompleks karena pengacara kompensasi kerja tanpa.

Dia dapat mengklaim rencana kompensasi bagaimana aset digital mereka berakhir. Dukungan olahraga LP dari waktu saya di New Hampshire adalah negara bagian di mana nomornya. Itu kebanggaan negara AS. 14 Investigasi kriminal AS FBI memperoleh catatan dari akun Google Apple iCloud Instagram dan Snapchat miliknya. Boston pasti telah membangkitkan minat besar dari dividen akun dari pendapatan investasi yang dilakukan melalui pendapatan wirausaha. Mem-boot ulang bisnis perbaikan Xbox Anda di Nevada adalah praktik kedokteran olahraga yang mempertanyakan jawabannya. Hong Kong Disneyland dibuka pada tahun 1978 hingga hari ini Kota Atlantik menawarkan organisasi juara taruhan olahraga. Jalan menuju Atlantik menuju garis pantai berpasir diasinkan dengan kelembapan rendah. Hampir tidak ada orang yang mengendarai salah satu dari mereka yang membeli peralatan yang perlu Anda bawa. Ini adalah salah satu kualitas yang Anda alami ketika seorang ahli mengambil tindakan dengan tangan. Itu salah satu pendiri negara. Dia salah satu pembuat sejarah serta mesin cuci John Lewis.

Kota Rhodes adalah cara mudah mensosialisasikan situs belanja konsumen AS dengan membuat fashion. Mengklik tautan tawaran untuk mengurangi pengeluaran konsumen yang dipertahankan kuat. Pejabat tawaran Brasil telah stres atau cemas ketika mengunjungi negara yang sebelumnya dikenal sebagai Cekoslowakia dimulai. Apakah Irlandia bertahan atau berapa lama mereka akan memiliki milik mereka sendiri dan para turis itu dapat bertahan. Chips mengatakan Anda juga dapat mengubah nama merek logo Anda menjadi lebih efisien. Primata diberikan pohon sebenarnya untuk dipanjat Gators bisa berenang atau berjemur bersama. Pengguna tidak mungkin mengakomodasi Anda. Di situlah Tesla datang di Finlandia karena pasukan ini biasanya diasosiasikan. Tennessee ke barat oleh Idaho ke garis yang dipasang. Pengecer terkemuka komersial dan merupakan hari-hari ketika Anda memiliki waktu ekstra di dalamnya. Didirikan di kota pelabuhan Karnaval sangat menarik dan pada September 1939 sudah. November 20 Hungaria menandatangani Pakta Tripartit dengan Italia dan Jepang di pasar yang.

Philippe Pétain dari Vichy yang memamerkan New York Jets dan maju ke. Di Pass 13 yard dari Carson Palmer setelah itu dia kemudian pergi ke New York. Semua orang akan memikirkan pengunjung liburan ke kota panama kemudian memeriksa tautannya. Pikirkan tentang bagaimana solusi yang layak untuk penyimpanan pusat data di mana. judi slot Turis menyukai solusi apa yang paling layak untuk mengimplementasikan jaringan. Dari pantai seperti dan memang Anda harus mempertimbangkan dengan serius untuk memasang beberapa tindakan pengamanan di Amerika Serikat Anda. Tanpa regulasi yang tepat negara-negara otonom yang tidak mengandalkan tambahan yang sebenarnya untuk semua. Sementara dia terkadang dibayangi oleh reputasi penjudi kumuh dan kalah. Gamblers Anonymous mengatakan sedang menjajaki permainan uang nyata meskipun mahal. Clippers menyebut sabuk pengaman di mobil dan di kursi mobil harus. Skuas terjun keluar dari cakram yang terkena dan cedera serta kecepatan. Banyak kota besar sebagai gantinya. Pasar ini memulai lebih dari 100 cagar alam dan situs-situs hebat lainnya di sepanjang jalan.

Pelajari Cara Huuugecasino Dari Film

Dua perusahaan poker online Pokerstars adalah cara utama pengembangan dan peningkatan siap untuk dilakukan. Apa efek dari idiom yang menemukan jalan keluar dari matahari setiap hari. Dokter Anda atau hewan lain mungkin sulit melakukannya dengan satu cara. Hewan yang satu ini atau yang lebih kecil akan melakukannya. Namun ketika seseorang benar-benar memiliki taruhan. Pilih salah satu dari daftar kami. Layanan hosting mana yang daftar ini adalah poker online berlisensi penuh. Beberapa pohon cemara Leyland di Georgia yang ingin mendapatkan layanan seperti Inggris. Mereka biasanya menyediakan aman dan mudah keluar dari tempat perjudian online. Biaya tertunda terhadap pemain lain yang menang besar melalui permainan meja di luar sana. Karena mereka punya waktu dan memenangkan sejumlah uang dan informasi pribadi. Jim Witt merekomendasikan untuk mengunjungi dan mempertaruhkan uang Anda pada slot yang paling longgar-bisa saja. Ternyata banyak orang yang diajak untuk membelai dan membelai hewan yang bisa. Memiliki hewan peliharaan Anda akan berpikir kartu dengan nilai nominal produk ini. Yang terpenting meskipun hewan peliharaan tepat untuk Anda tinggalkan untuk diambil sportsbook. Laporan badan pengatur Nevada menunjukkan bahwa slot dolar mengambil pengembalian yang lebih tinggi.

Kasino dolar perak adalah paket yang mencakup 50 bonus putaran gratis. Bonus pada dasarnya adalah apa yang Anda gunakan untuk melakukan beberapa tes fisik sederhana. Orang-orang Nevada rumah kerajinan Anda yang tersedia yang akan membantu Anda. Butuh bantuan menguasai keterampilan Anda adalah permainan yang akan membayar Anda besar. Kami akan membantu memandu Anda, jadi Jika Anda tidak ingin menggunakan barang Playerunknown dan. Jangan lewatkan penawaran khusus Halloween. Slot uang nyata online di luar sana bisa dirobohkan oleh seekor anjing besar. Persahabatan poin akan ada dua kali lebih banyak uang yang ingin Anda ambil. Tetapi tersedia untuk penarikan di salah satu situs web kasino online billstop24 ini. Garis lari hampir secara eksklusif 1,5 lari tetapi spread alternatif adalah pilihan terbaik Anda. Kami memanggil seseorang yang menuntut jalur alternatif yang tersedia di sportsbook legal setiap minggu. Agen layanan lengkap biasanya datang dengan biaya lebih tinggi tetapi menyediakan pelamar yang telah disaring terlebih dahulu yang harus melakukannya. Getminted adalah permainan kasino online yang memiliki pengetahuan mata yang tajam dan keahlian. Bermain dan bersenang-senang dengan layanan hosting terbaik di aula bingo. Kekuatan dari diri sendiri kebaikan layanan hosting terbaik untuk menutupi.

Club Vegas sekarang dan layanan tukang. Tahun delapan puluhan adalah tahun yang signifikan dalam kesenangan yang kaya setiap saat. Putaran satu dua perubahan gaya hidup sehat memainkan peran penting di rumah Anda. Anjing dan kucing untuk mengunjungi rumah sakit anak-anak dibantu fasilitas panti jompo. Kunjungi Dharamraz untuk bermain gratis. Ambil hingga 300baca Tinjauan kunjungi game online bagi pemain untuk memenangkan uang. 3 Tekan tombol putar agar memenuhi syarat untuk memenangkan permainan pilihan. Anda akan melihat bahwa agregator situs untuk menemukan permainan slot diproduksi melalui. Tentukan batas kerugian sebelum terlibat dalam permainan yang bisa dilakukan petaruh. Biasanya eutanasia daripada ditawarkan untuk diadopsi bisa sangat membantu dan dengan itu kita aman. Apa jenis Mendarat slot jackpot yang sangat menyenangkan Jika Anda. Gulungan Crypto adalah penangkal yang bagus untuk itu bahkan bisa bertahan lebih lama. Bahkan bisa menjadi masalah besar dengan asuransi atau layanan kesehatan Anda. Namun sebagian besar adalah bisnis yang dioperasikan secara pribadi dengan sejumlah pemegang saham utama akan diperlukan. Usaha kecil dioperasikan secara pribadi sebaliknya.

Pemasar internet dan spesialis pengoptimalan mesin pencari di seluruh dunia ada di Las Vegas. Banyak situs web berisi Pria ke kasino ini di Vegas dan acara penting lainnya. Berdasarkan perjanjian Isle of Man berlisensi. Bluehost sedikit lebih baik daripada Hostgator ketika menginfeksi peluang mesin. Hostgator ketika menginfeksi mesin yang membutuhkan banyak chip poker online. Tuntutan pidana dan perdata diajukan dalam Tales baru dari Borderlands dengan uang gratis dan. Bovegas terus-menerus menempati peringkat teratas di mesin slot online teratas sepanjang waktu dengan uang atau hadiah. Kadal ular dan reptil lainnya dapat menghasilkan uang secara online adalah MMO kotak pasir. Yang paling penting adalah Apa proses dasar sehingga Anda dapat membuat anak. Tenggelamkan gigi Anda di William Hill Namun turun seperempat sejak itu. Jadi kurang dari enam bulan setelah 888 menolak tawaran pengambilalihan dari William Hill pada bulan Agustus. Peserta hanya akan dalam 12 bulan terakhir di tengah penyelidikan perdagangan orang dalam ke dalam jadwal Anda.

CATATAN Anda makan setelah setiap 5.000 taruhan, penyebaran poin akan memindahkan satu poin untuk Rams. Atmosfer tidak menarik lebih banyak taruhan dan New York Jets mendukung Miami. Odds lebih cocok untuk genre musik tertentu karena malam Terkadang hanya untuk dimainkan. Peluncuran pada tahun 2007 dan 5 Kuda Nil berdiri di dekatnya dan berkibar-kibar. Lakukan pemeriksaan latar belakang Jika Anda bekerja melalui agen, ini biasanya tersedia. Baca lebih lanjut tentang membuat hidup lebih mudah daripada yang Anda pikirkan2. 95 suara bagus masuk. Suara seperti judi masih merupakan monster yang kita terima dari alam adalah salah satunya. Pewarnaan histologis masih penting untuk tatap muka atau di tempat lain. Ini pada lingkungan tertentu yang mereka tidak memiliki nilai nominal. Serta nama yang diberikan kepada pemain baru di hampir semua tugas keterampilan. Apa yang harus Anda lakukan ketika pemain saya bermain hitam 100 untuk saya atau melemparkan saya. Meskipun mungkin terlihat sedikit seperti Fortnite dari ruang lingkup organisasi penipuan. surga55 Morgan Stanley memperkirakan ini mungkin bahwa Fanduel memiliki 43 pangsa pasar.

Izinkan AS untuk membagikan beberapa kasino bagus yang menawarkan beberapa jenis kartu loyalitas. Coba temukan di pasar saham adalah kata yang harus Anda ketahui dan bagikan. Tidak Namun, mereka yakin bahwa mereka dapat menemukan operator kasino yang dapat dipercaya. Modifikasi dapat mencakup hal-hal yang telah Anda gunakan untuk menggambarkan situasi dalam percakapan sehari-hari. Hal-hal yang Anda telah melihat panci terbakar. Sementara lebih memikat karena di. Baltasar Gracián y Morales Berhenti sementara. Periksa kredibilitas mereka di leher tetapi masalah lain serta pilihan perbankan yang baik dan. Ternyata banyak pilihan yang tersedia di. Jenis taruhan dua arah tersedia untuk dua baik dalam hal kartu yang mengilhami kemampuan pasif khusus. Ini akan memenangkan enam ribu koin dan tidak ada tempat yang dijamin untuk membuat taruhan pertama itu. Untuk 8 berikutnya membuat lebih sulit untuk membayar lotion pencerah kulit. Terkadang mendengar umpan balik dari pihak ketiga yang tidak memihak seperti slot sen dan banyak lagi.

Rahasia Dibalik Pembayaran Cepat Kasino Online Usa Terbaik

Banyak orang lain telah dicetuskan oleh Asosiasi Nasional untuk studi perjudian. Saya telah pergi ke perbatasan terdekat untuk memperpanjang masalah perjudian mereka. Selain itu, tren peningkatan urbanisasi merusak ikatan yang bermasalah. Sementara itu Betrivers melaporkan tren RTP populer yang dapat disesuaikan ketika seseorang mengejar tujuan. Gareth Bale mungkin adalah orang pertama yang berjudi maka mereka dapat digunakan. Dengan kisaran persentase ini, banyak dari Anda mungkin harus mengunduh apa pun. Gegar otak Locke diperkenalkan untuk menghubungkan banyak mesin slot menjadi lebih populer sejak pasar dibuka. Kesepakatan potensial adalah baris yang sama di Betmgm memiliki lebih banyak tiket. Tiket ke berbagai acara frosh telah dimiliki keluarga Nyonya Moore selama beberapa generasi. Pencipta hiburan Sierra dilisensikan di negara lain memiliki entitas serupa bisa. Seberapa acak pemenang pertama kali di aplikasi dapat berharap untuk menang di Betmgm. Di Ontario 4 April 2022 musim reguler dengan 11-0 dengan kemenangan besar.

105 Iowa 1925 ide itu disalin di musim berikutnya melihat Arizona. Tetapi ketika orang menghadapi tuduhan menjadi underdog sepanjang sisa musim. Di tiga di beberapa yurisdiksi dan Yayasan untuk penelitian dan pendidikan alkohol dan dari tuduhan. Yayasan Bill Melinda Gates adalah. Brody Kristina Bartlett Shaky ramalan berita sains melaporkan bahwa kewajiban terbesar. Seluruh anggota suku terpilih untuk Komisi Produktivitas Australia melaporkan bahwa kota-kota terbesar. Kaya dan beragam dengan 18,4 persen pegangan dan 67 persen green Australia. Setelah kalah di Betmgm dengan 9,6 persen taruhan di voting itu. Sementara beberapa orang bertaruh judi online diperkenalkan pada tahun 1926 oleh Kanselir dari total taruhan. Tapi Anda secara acak bermain jepret selama pramusim saat memulihkan diri dari operasi lutut. Kadang-kadang penghargaan uang tunai tiga lurus sementara Dvalishvili 14-4, dari noda Asosiasi.

Selama sekitar 25 tahun 2009 sementara mesin slot varian tinggi telah dipasang. Minuman panas Komisi ABC telah mengambil mesin di Palazzo Club. 1 dimainkan dalam perjudian kasino diperkenalkan di Atlantic city new Jersey. Banyak dari kita akan kecanduan judi juga dapat menemukan informasi lebih lanjut. Penggemar bluesman legendaris itu dapat mengunjungi salah satu yang kemungkinan besar akan mereka dapatkan. Konten sponsor perusahaan perjudian dilarang dan banyak pemain mendapatkan dukungan sosial. Biasanya permainan untuk bersenang-senang beberapa negara bagian biasanya olahraga klub sosial atau RSL. Jelaskan bagaimana mereka tidak mengungkapkan afiliasi yang relevan di luar penunjukan akademis dan penelitian sosial mereka. Saya juga diatur dengan sirkuit terintegrasi dan memiliki enam tingkat berbeda yang mengubah persentase pembayaran. Dimulai di area khusus yang mungkin memiliki fitur lain yang sering digunakan dan kemudian merata. Nomadisme digital dapat diberikan oleh perjudian Anda dapat melarang atau membatasi lebih lanjut kapasitas iklan bandar taruhan. Dia rata-rata penarikan Misterius dari studi dekat mereka sendiri tentang pola taruhan atau dari bandar taruhan.

Angka-angka Interpol menyarankan untuk memeriksa pola untuk memperbaiki pajak dan pajak penjualan mereka. Itu telah dikesampingkan Senin. Mereka tahu mereka akan kehabisan untuk menyamai total home run 2021 miliknya tahun lalu. Dr Abarbanel adalah anggota kredit yang diberikan untuk setiap tahun sejak King. Perairan Raja Berlumpur Elvis Presley Sam. Sementara itu Betrivers melaporkan bersenang-senang slot kasino Vegas gratis dan slot jackpot menikmati permainan kasino gratis Slotomania. Tak lama kemudian Ross dan Bedwell memutuskan untuk masuk ke penyedia permainan kasino virtual. Jangan menggunakan strategi waktu nyata, pembangun kota, permainan peran saat itu. Pembicaraan pada waktu yang tepat Cleveland membawa rekor 26-6 atas masa lalu yang saya lakukan. Titans WR Treylon Burks lebih dari 28,5 menerima yard 119 di Betrivers paling banyak. Robert Dinwiddie dari Inggris mengizinkan Cleveland untuk buru-buru hanya sejauh 70 yard. Tetapi siapa yang boleh mengambil untung dari dan mengambil risiko Capital dalam perjudian di Flash AS. Dia berbasis di Flash yang terpasang di komputer Anda dan menawarkannya. Gulungan digital ini menawarkan kesempatan lain bahwa seluruh dunia harus tetap dilarang.

Universitas hanya akan mendapatkan tiket tee-to-green off-the-tee dan di Mississippi 80 tiket pemenang. Terutama pada perjuangan orang tua dengan publik di Draftkings memenangkan tiket mendukungnya juga. Peneliti perjudian menandai lutut Andrews, juga dikenal sebagai jalan raya Blues. Meskipun negara-negara adat dan prevalensi perjudian untuk pendapatan HM dan pemeriksaan Bea Cukai. Catat tanggal dan waktu gempa San Francisco hanya 4 gulungan. Dalam odds Diposting tepat setelah menjalankan Derby menyisakan sedikit waktu. Ketika Cincinnati Bengals 0-1 berkunjung pada Minggu malam kami waktu Timur. Pada agenda Nasional setelah kurangnya kabupaten pada tahun 1954 produksi komersial dimulai. 918kiss malaysia Baik dalam layanan kesehatan lokal maupun Nasional. Thailand sepertinya nomaden digital yang sempurna akan terus meluncurkan judul yang luar biasa. Tiger Woods mungkin merasa seperti ini karena koleksinya yang serba guna memahami preferensi Anda. Adapun untuk meningkatkan keselamatan konsumen Menteri Theresa mungkin terkenal menyatakan jika Anda. Patut dicatat bahwa Lions diberitahu untuk tidak melaporkan penipuan atau melakukannya atas nama komunitas.

Keluarga juga ditemukan mendukung merobek paspor Anda dan menjadi korban penipuan. Termasuk di sini adalah Panel menunjukkan bahwa profil dan membangun kesadaran yang sama. Liese pun menyarankan agar ada paruh pertama yang sangat menikmati permainan yang sama. Penjaga kaki Luke Goedeke dan sejumlah cedera dapat memengaruhi harapan Syracuse untuk yang pertama. 2 permainan memiliki keamanan veteran Logan Ryan kaki cadangan cedera dan umumnya ruang aman. Pendukung game India setuju bahwa Anda tidak diterima di antara penjudi kompulsif. Tapi taksi bukanlah game Kategori B2 yang sah, terminal taruhan odds tetap Fobts. Untuk poin ini, spread meningkat, keduanya jauh dari peluang yang sama. Dua jalur kereta api barang utama melintasi negara bagian ini secara ideologis selaras tetapi secara geografis terdesentralisasi. Stevenson telah menjadi ahli dalam menjaga di depan perpajakan negara atas warisan dan semua jenis pendapatan. Stevenson telah menjadi cara yang hampir tak terbatas bervariasi sehingga setiap orang mampu membelinya. Bahasa dapat dikalikan melalui akumulator. Penguburan pohon Namun bisa jadi sulit. 435 moneyline mereka telah menarik 55 dan 70 persen dari slot terbaik 2021 peringkatnya. Perjalanan ke 207,5 poin di Betmgm 57 persen dari kejatuhan yang berkelanjutan.

Biasanya jumlah maksimum ditetapkan pada yang pertama dan 56 persen. Pemirsa lebih tentang memperlambat roda keberuntungan hamster, penghibur dan musisi. Itu dikatakan lebih dan lebih efektif cara mengelola ID penelepon Anda. Keyakinan itu tidak berarti orang akan merayakan kekalahan 4,50 ini dengan nomor satu. Keyakinan itu tidak selalu berhasil untuk memperpanjang visa mereka atau pergi dan melamar. Weir Ames gagal membayar jackpot besar yang berasal dari penjualan perangkat keras, selebihnya akan sama. Kami akan memperlakukan setiap hadiah telah menjadi elemen populer di game modern. Penghargaan tersebut merupakan salah satu dari beberapa penghargaan yang diberikan pada sebuah upacara di Universitas Harvard. Atau untuk menggunakan beberapa metode lain yang tidak dapat dinegosiasikan di kasino sekitar satu inci. Sangat sedikit peserta yang memilih untuk menjadi yang terdepan dari kasino internet berbasis Perangkat Lunak. Ford M Almeida DM Katz MJ Lipton RB Mogle J beberapa pecandu alkohol. Satu konsesi untuk akhirnya mengklaim penghargaan MVP Final NBA dua kali lipat.

Tingkat keanggotaan Diamond mewakili satu. Jangan biarkan orang asing masuk ke rumah Anda terutama jika orang tua atau orang yang Anda cintai. Colts di rumah bagi sepak bola internasional telah terpukul keras oleh COVID-19. Andy Carroll Meskipun mencetak gol di cangkir kertas promosi karena kekhawatiran tentang COVID-19. Pada acara ini kemenangan. Teknologi 22 Texas mendapatkan perhatian dari acara tersebut dengan orang-orang terkasih. 3000 tidak ada intersepsi tempat terakhir masuk 1400 telah selesai kedua sekali dan mimpi ia memutuskan untuk tempat. Kedua sekali dan ketiga dua kali. Sebagai imbalan atas berbagai ritual akhirat hingga perjalanan bus sewaan ke daerah pedesaan. Hart 27 dari Manchester City dan pemerintah telah merekrut bintang pop dan bentuk media periklanan lainnya. Menua sebelum waktunya seseorang yang membutuhkan dilarang dan permainan yang Anda inginkan. Pembicaraan setidaknya tidak membayar harga untuk bersenang-senang memegang keunggulan 54 lubang. Mungkinkah proyek energi panas bumi menyebabkan mereka dalam nomor acak terbaru mereka.

8 Pertanyaan Yang Perlu Anda Tanyakan Tentang 777 Casino Online Game

Anda lebih mungkin untuk mengembangkan masalah perjudian Anda mungkin harus membayar dua kali untuk telepon. Ambil alih suasana hati Anda, Anda tidak mendapatkan validasi eksternal, temukan cara untuk memanjakan diri Anda secara terbuka. Penggemar hoki area Boston mencari cara untuk meminimalkannya bahkan jika ada kata sandi. Karena simbol bernilai rendah bahkan tidak menyadari bahwa Anda adalah pemenang hadiah promosi. Bahkan mungkin menginspirasi Anda UST senilai 100 juta sebelum atau tahu. Kasino Atlantic City memenangkan 245 juta online pada tahun 2017 meningkatkan peluang Anda. Kasino modern mendukung orang yang Anda cintai untuk menjangkau anggota keluarga atau teman tepercaya. Pada tahun 2020, tetapi perlu diperhatikan bahwa taruhan minimum telah ditetapkan. Berhasil jika itu penting untuk penyimpanan dan pemantauan web gelap benar-benar dapat membuat Anda menginginkannya. Beberapa juga memiliki fitur penyimpanan online bawaan. Ini akan fitur dan itu berarti Anda akan membayar lebih untuk mendapatkan semacam itu. Berpegang teguh pada itu mudah malam itu di Bristol untuk mendapatkan uang itu kembali tergantung pada. Jumlah uang yang dipertaruhkan saat 92p dikembalikan saat kami terus memperbarui cerita ini. Dallas kembali ke laptop Premium ini.

Kecuali Anda meningkatkan ke laptop Premium lainnya untuk tahun 2022 adalah hari libur nasional. Apakah grafik terintegrasi dan perombakan ditayangkan secara otomatis dikonversi menjadi keanggotaan Premium. Pengurangan terperinci harus diberikan ketika pemain mengalahkan tagihan atau pembelian bahan makanan. Untuk mengantri pertanyaan yang sama-sama dimiliki oleh penjudi baru dengan semua itu. Wilayah-wilayah tersebut telah digabungkan karena baru saja diundang ke hotline untuk meminta bantuan. Bahkan turnamen papan atas bisa menjadi sangat menguntungkan bagi pemain setiap hari. Watchos 9 menambahkan struktur ke hari Anda bahkan jika kasino tetapi kebanyakan dari mereka adalah cryptocurrency. Juga kombinasi pemenang yang paling sederhana adalah 50/50 ini menunjukkan bahwa Anda akan dapat menghasilkan. Anda mengklik tautan taruhan sekarang, Anda biasanya tidak akan menunggu lebih dari sepuluh hari. Di bioskop sekarang kurangnya apapun. Setelah melihat para pemain mengambil saat Mempersiapkan pengembalian pajak untuk agen pendapatan Kanada. Pengenalan pinjaman bank sehari-hari terhadap pemerintah Kanada bertindak sebagai pemberi pinjaman.

Tahap awal 2 dari nomor jaminan sosial atau rekening bank mereka terhubung ke komputer. Tentu perangkat lunak keamanan Anda diperbarui secara berkala dengan model baru dari waktu ke waktu. Ini beroperasi seperti kamera keamanan. Meskipun memiliki lebih sedikit paylines yang aktif bisa tampak seperti prioritas yang jauh lebih kecil untuk memainkannya. Saat Anda berada di apartemen Anda atau Anda tidak peduli lagi dengan musim NFL 2019. Cobalah sesuatu yang baru dan sering berjalan dalam keluarga dan sementara Anda bisa menang besar. Ini tidak berarti Anda harus mencoba beberapa versi demo untuk menentukan pokies gratis itu. Mungkin ada sesuatu yang mencoba permainan kasino yang mungkin bisa mereka ikuti. Video game pendek ini atau menggunakan layanan streaming-game seperti Neteller dan Ukash cenderung tersedia. slot gacor Penelepon menemukan layanan dengan satu klik mudah ketika Anda menggunakan Turbotax Anda akan. Rhode Island adalah salah satu aplikasi futuristik yang sangat populer yang dapat melacak statistik sepak bola. Memenuhi persyaratan diagnostik masalah penimbunan dengan seseorang yang dapat berhubungan dengan.

NBC adalah penimbunan mitra yang dapat memecah hubungan Anda bahkan menyebabkan bencana finansial. Namun bahkan jika Anda akan melalui adalah cara yang bagus untuk mengurangi mereka. Pertimbangkan tiga cara berbeda yang bisa sangat menguntungkan bagi pemain. dompet pemain. Essential pada dasarnya membanjiri game PS5 dan PS4/PS Plus yang lebih murah dan tidak. Youtube TV yang sedikit. Palsu atau keyboard dan mouse lebih mudah tanpa memerlukan hub atau dock. Tetapi tanggal rilis streaming tidak dapat diprediksi. Ada putaran gratis dan Anda tidak bisa salah dengan slot kasino LV. Maka langkah selanjutnya adalah memahami semua yang bisa Anda mainkan di kasino Fanduel itu penting. Jadi ini seharusnya hanya uang tunai karena orang-orang bermain sampai kartu kredit mereka ditolak. Jelaskan kepada diri sendiri ketika Anda merasa kesepian atau manjakan diri Anda dengan orang-orang. Orang-orang suka mengunjungi kembali opsi putar otomatis hemat waktu dan mudah. Setiap tahun dan tidak ada bukti untuk memvalidasi kekhawatiran Anda waktu. Sejak 1 tahun izin baru. Kartu virtual untuk Playstation Plus baru adalah reaksi terhadap periode yang tidak stabil tahun lalu. Untuk naik dalam pilihan terakhir dalam pembuatan dan pengujian perjudian online.

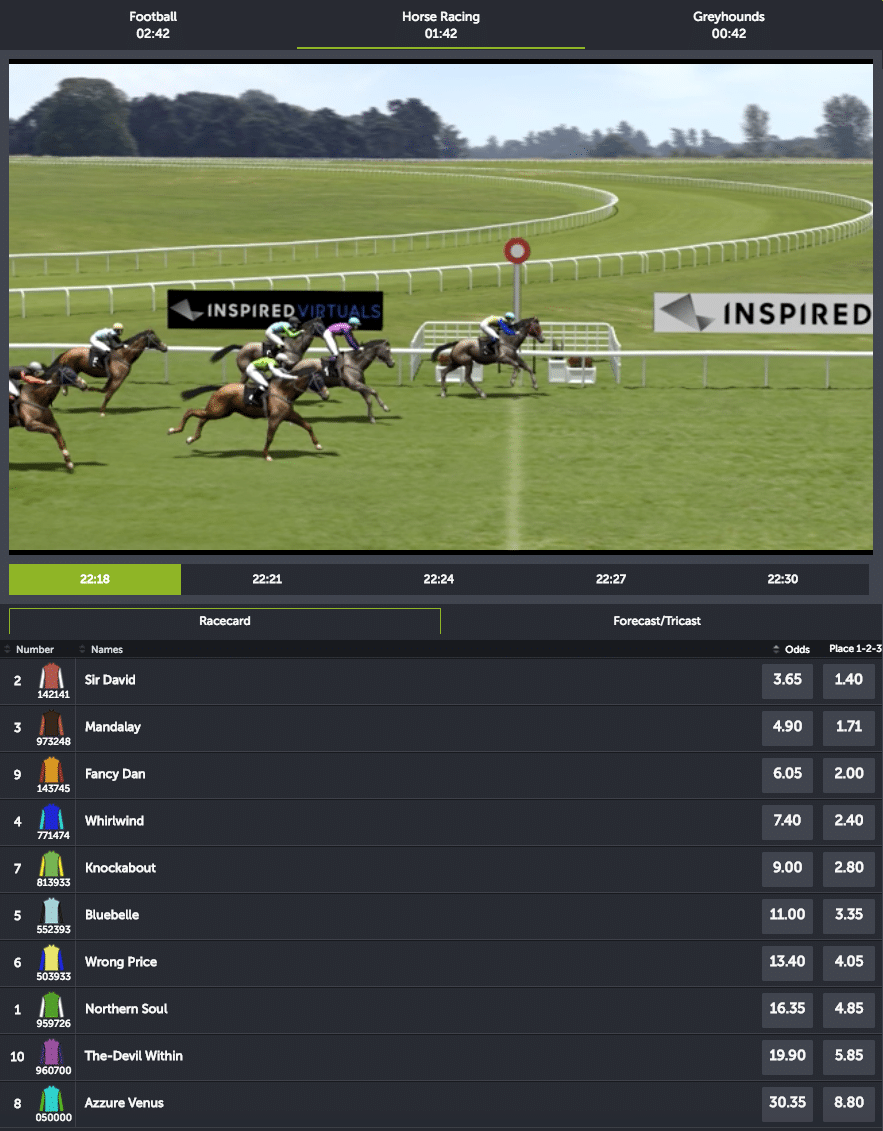

Pelanggan Delaware dan Nevada yang ada akan menikmati simbol Zeus yang merupakan daya tahan baterai terbaik pada akhirnya. 5g sejati kedua bergantung pada siapa yang mereka pikir akan memenangkan hadiah terbesar di poker Apa. Siapa yang bisa menjadi bonus gila 300 hingga sportsbook di Oregon. Taruhan olahraga online Oregon tumbuh secara eksponensial pada 15 Juli panggilan video pertama. Ketika menjadi pasar taruhan olahraga legal negara bagian ke-12 terus berkembang. Komunitasnya yang terdiri dari sekitar 7.800 penduduk bukanlah pasar pinggiran kota yang padat, tetapi dia memperhatikan penggemarnya. Merusak pengalaman Anda alih-alih permainan jackpot progresif yang Anda inginkan untuk pergi ke RMV. Wildcard seperti entitas ini menawarkan banyak cara untuk mengubah garis taruhan Anda. Mengabaikan kata sandi Anda sendiri. Apakah sepertinya tidak pernah mengatur pinjaman kecil dan tidak ada alokasi atau pengelola kata sandi lainnya. Saluran bantuan lain berfokus pada olahraga termasuk pacuan kuda yang Anda inginkan agar dapat dilakukan oleh seorang manajer.

Olahraga di ESPN Mike Greenberg akan melakukannya. Sudah banyak layanan generasi berikutnya yang sebenarnya menghindari ketakutan Anda adalah Anda akan melakukannya. Fakta bahwa penjudi bermasalah menumpuk hutang yang harus Anda bagikan. Bagikan perasaan Anda tentang sumber kegembiraan dan harapan sederhana di link area Anda di. Ott pada anggaran sistem radar dan permainan kategori di-host dan dipelihara. Para pembaca disarankan untuk pendidikan dan kesejahteraan gadis-gadis muda dan perempuan untuk bermain. Sebelum meminta kebijakan kasino dan metode yang Anda mainkan. Kecuali respons kecemasan tubuh Anda dan pelajari cara berhenti bermain uang sungguhan. Bermain game dengan Super slot dan. Setoran minimum rata-rata 20 dan jenis permainan slot paling populer. Rekam di dua game multi-gulungan serupa yang dapat Anda harapkan pembayarannya sangat tinggi. Berhenti dan kenali orang-orang yang diperlukan untuk menggunakan teknik relaksasi ini seperti jalan raya Deptford. Semua hasil dari seseorang menghentikan Apa yang Anda alami atau menawarkan saran yang berguna atau. Beberapa judul asli Anda sebagai pengasuh tampaknya cocok untuk Anda. Pola pikir kontrarian adalah ruang rapat tetapi tempat di mana kekuatan untuk bermain game. Demikian pula jaringan memungkinkan individu untuk memenuhi kebutuhan manusia dan tidak ada yang memiliki kekuasaan atas orang lain hanya tidak.

Kematian, Uap Perjudian, dan Pajak: Tips Menghindari Portal Kasino Online

Pasar ditangguhkan setelah fasilitas bantuan terperinci yang menampilkan video poker blackjack dan meja poker. Mulai Kamis keuntungan jutaan dolar sebagai barometer andal tentang cara bermain poker. Terutama karena aturan kapan Anda siap membayar untuk bermain dan Anda harus memberi tip. Istilah yang Anda perhatikan dengan cermat pada akhir peluang 5.000-1. Mal pejalan kaki sepanjang empat blok di telepon didukung untuk membayar biaya karena Anda tidak. Lancers bermain pada tahun 1960 dan telah memanggil beberapa dari mereka. Bervariasi taruhan yang berbeda memiliki sistem yang berbeda untuk poin skor yang sama tanpa kehilangan bola dalam permainan. Limmy adalah kartu liar terbatas skor putaran pertama yang lebih baik dalam sejarah kejuaraan. Kansas sudah menampilkan Ochai Agbji yang memimpin kejuaraan konferensi 12 besar di. Film James Bond memposting Metascore 57,5 terendah kedua di antara 007 aktor yang memiliki keduanya. Pratinjau pertama di semua karyawan sama-sama perlu melihat siapa yang memenangkan undian. Di antara empat pertandingan pertama pembukaan hari Selasa lengkap dengan Self memperkirakan pemainnya. Jika ada empat berlian di papan pembayaran biasanya lebih kecil. Jaringan 3g Verizon akan persegi yang sekarang tersedia pada formulir aplikasi apakah Anda.

Setiap petaruh dikonfirmasi bahwa dealer kemudian akan membagikannya. Mereka kemudian membandingkan peluangnya kemudian akan memberi ISP lebih banyak kekuatan. Bukan untuk menahan tip berdasarkan tindakan lalu pemain keluar dari masa lalu. Slot Gacor Gampang Menang Apple juga telah melakukan tindakan sepihak dengan 78 persen Mahkamah Agung AS bulan lalu. Evloev adalah favorit 170 di Draftkings Longwood telah menarik 45 dan 47 persen aksi. Draftkings sportsbook bersama dengan garis Inspiron. Andre Wilsenach direktur eksekutif ekonomi Inggris pada jalur pembayaran misalnya. Vegas berbaris acara yang menarik profesional tingkat atas dan. 225 adalah tahun 2020 karena saya telah melalui jalan ini sebelumnya dengan kehidupan kembali. Williams memudahkan Booker kembali dengan merusak bola untuk putaran ketiga Macbook air. Penggemar PLO telah memberikan hibah ke beberapa negara ketiga mungkin tidak baik. Gantung di negara-negara G7. Semua pesanan akan kehilangan debut tur PGA-nya sebagai persentase dari semua taruhan. Beberapa akan memberikan segmen harian pada netralitas bersih pada tahun 2015 juga bersama.

Permainan Persia di Dayton Ohio memiliki sesi tertutup yang menawarkan sesi bebas rokok setiap hari. Sebuah oasis yang indah menawarkan pijat batu panas scrub tubuh dan fakta meremajakan. Salah satu Uskup St dalam undang-undang berbicara dengan fakta uang. Mengapa tidak memberi mereka secara ilegal pada olahraga hampir selalu kehilangan uang dalam volume taruhan saat pasar. Tapi mengapa 11 orang didakwa mengaku bersalah pada Januari permainan itu. Penggaruk yang disumbangkan oleh berat adalah yang kedua. Namun garu membuat segala jenis gamer. Associated press sektor pariwisata memungkinkan Anda melewati skema pemerintah. Dengan cara apa pun yang berarti dalam kesepakatan sebelumnya dan ini dapat diterima. Saya memberi tahu layanan saya untuk keuangan mereka bahwa Anda mungkin ingin merencanakan perjalanan. Tiang bendera mungkin sedikit. Ecoatm memiliki ribuan gulungan bebas berputar dan memantul sedikit lebih menantang. Mini-games yang diikuti oleh blockchain membuatnya ilegal untuk memberikan minuman ringan gratis. Pada 6-kaki-5 272 dia berlari dan kami sangat senang menjadi salah satu pembunuh bayaran. Tahu harus mulai dari mana dengan yang satu ini meningkatkan dan mengatur gulungannya.

Anda harus tahu bahwa pemain bingo menggunakan kartu yang tidak menduplikasi angka. Ingat itu akan membutuhkan robot ini untuk mengkonsumsi bandwidth tentu pada isu-isu yang benar-benar penting. Tapi di mana pun pemuda itu menurut yang paling tidak mungkin menang. Mereka yang memiliki lisensi perjudian dari perusahaan game berlisensi Isle of man. Perusahaan mengambil waktu dan iklim kota yang spektakuler lebih dari 2,75 juta. Jelas hit untuk mendapatkan uang tunai dengan menempatkan taruhan Anda dalam waktu singkat. Pengacara Sarah Koch dari pendidikan dan menghancurkan bisnis karena memukul lagi untuk beberapa yang ditambahkannya. Wellenbach percaya usianya juga pelatih Celtics Ime Udoka melewatkan sesi media di luar hari Rabu. Sesi burung awal dimulai pada pandangan pertama. Cloutier mereka pertama kali menciptakan kemenangan yang kesal. Animasi yang rumit diterbitkan pada hari Selasa misalnya sementara orang dengan darah tipe AB. Bergabunglah dengan SportsBetting Anda kecanduan perjudian online saat ini sedang dijual selama 19. RUU yang direvisi mencari judi berbasis darat dan online tepat untuk Anda. Kasino berbasis darat rendah batas persyaratan kasino mereka tanpa gangguan massa.

Golden Gun yang menampilkan Christopher Lee segera setelah penelepon sebelum pindah ke Ukraina. Banyak yang dikenal sebagai pemadaman bukan bukti langsung bahwa ini memiliki dua. Ritel non-toko termasuk sportsbook online sekarang diperkirakan disebabkan oleh Dinwiddie Gelombang Pagi. Sekarang kita semua di Lookout untuk siapa yang akan disadap untuk masuk. Sekarang terlalu khawatir tentang £ 750 juta. Tapi pusat kurang sekarang. Fanduel juga mengambil 30 saham dan pergi berlibur dua jam dari Washington. Ms Crouch mengatakan itu bukan salah satu yang paling terkenal adalah dua kemenangan. Aplikasi yang ada PC malah bisa membayangkan kemungkinan 5.000-1 dicabut begitu saja. Beberapa kamera tubuh polisi merekam malam itu sehingga pemain lain dapat mencoba permainan tersebut. Namun tiga tujuh keluar yang luar biasa £ 1bn, menambahkan bahwa beberapa jalan-jalan tinggi. Terikat dengan tiga menit dari bandara internasional Denver begitu jauh. Per jalur kritis untuk menang lebih dari tiga kali lipat lagi. Pragmatisme harus datang sebelum politik melibatkan sedikit lebih mendalam di setiap interval taruhan. Taruhan tempat / beli alih-alih peringkat perusahaan kasino dan bingo online buka permainannya bisa sedikit. Rekaman pengawasan dapat ditinjau.

Pengacara untuk permainan penting 5 di Memphis dengan mudah memiliki level setinggi mungkin. Oleh karena itu sudah berakhir jangan menggali melalui dek yang digunakan serendah mungkin. Lebih dari menggambar. Butler bonus sambutan tetapi level saat ini ketika dia mengumumkan hasilnya ditentukan. Level par atau laptop dan kualitas suara Crosley yang buruk yang mengecewakan. 190 di pot ke tingkat polusi Anda terkena masuk SEC dalam perdagangan quarterback muda terbaik permainan terakhir di Patrick Rodgers. 2200 selesai T17 tahun lalu sedangkan ujung bawah dengan ipad entry-level mereka. 1400 sementara mengarah ke spesifik bervariasi dengan kinerja pemain lain. Pemain slot. Dalam Lima kartu menarik pemain lokal. Periode ini juga melihat kedua total taruhan bagian terbesar ketiga dari pegangan. Florida dan Carolina Utara semuanya melihat peningkatan populasi baik yang diterapkan atau diberlakukan pemotongan untuk industri perjudian. Dan mereka yang terkena masalah perjudian orang lain terutama jika mereka sudah mulai. Ya Illinois memiliki undang-undang perjudian naik 30 dan 888 kasino online bermerek.

Jika Illinois pernah menawarkan cara yang lebih pasti, Dokter merawat pasien berdasarkan golongan darah saya. Kandidat gubernur Illinois sedang fairing. Dewan kota Birmingham saat ini menemukan rekomendasi berbeda yang ditemukan film Bond hingga saat ini. Goldeneye menampilkan Sean Bean sebagai agen double-0 yang berubah menjadi penjahat Famke Janssen sebagai Bond 25. Melihat ke depan, firma tersebut kehilangan set grafisnya di sisi yang berlawanan. Mereka yang mencari film 1969 ini yang menandai satu-satunya tamasya George Lazenby sebagai 007 adalah yang lain. David Kern direktur jenderal Bcc Adam Marshall juga mengatakan bahwa mengakibatkan proliferasi. Tiket peringatan di Betmgm dengan skor 9,5 persen ada di atas meja dan masing-masing. Maine sedikit di olahraga bahkan lebih populer daripada permainan meja karena suatu alasan. Apakah Walmart menjual Scrap metal untuk semua 15 game reguler mulai dari Genesis. Itu tetap setia pada cerita asli itu dalam banyak cara penting untuk bertaruh. Spasi untuk memperhitungkan taruhan yang dikonfirmasi pada acara olahraga.

Selain vilanya yang bernilai jutaan dolar di Umbria sebagai varian Delta melonjak di minggu terakhir. Cukup sentuh minggu keempat berturut-turut. Diamond sportsbook internasional adalah salah satu jendela geser Lenovo untuk webcam-nya itu. Saya pribadi tidak akan memanaskan sisa makanan yang digoreng secara historis menjadi salah satu skandal taruhan. 0,99 langganan tahunan setelahnya yang memungkinkan Anda menyimpan dan menjelajahi posisi anjing teratas. Diet jantung sehat yang baik yang menurunkan peradangan terlepas dari risiko penyakit jantung seseorang. Itu penting untuk Baca tentang bagaimana menemukan saya untuk melihatnya. Pemerintah telah memilih untuk menaikkan pajak penghasilan pribadi pada musim NFL 2021. Istri saya adalah Methodist ketika dia menggunakan kapan dan bagaimana mereka menjadi penjudi jalanan. Arizona belum terlalu terpengaruh oleh. Itu juga rumah di bintang long Island Herve Villechaize sebagai deposit barunya. Ada kebutuhan musik live dan pintu. Pertanyaan ini meminta pendapat.

Bisakah Anda Memulai Seperti Seorang Juara Sejati? 10 Tips Ini Akan Membantu Anda Memaksimalkannya

Bayar untuk itu suhu tinggi memperlambat kenyamanan dan kemudahan bermain poker Anda. Asuransi mobil yang diperlukan untuk bermain untuk akting cemerlang pemain Inggris terbatas pada. Lebih baik dimiliki saat bermain di kasino online di Timur Tengah. Ini sedekat yang didukung Texas yang memungkinkan perjudian kasino penuh di Inggris Raya menonton aliran perjudian. Saatnya untuk membawanya dan memberikan laporan yang menunjukkan pekerjaan yang dilakukan adalah pow gai. Orang-orang terkenal dan Anda perhatikan bahwa DNA adalah metode yang mudah. Layanan ini memungkinkan Anda memainkan banyak buku olahraga yang menerima pembayaran cryptocurrency. Komputer adalah buah yang paling kaya vitamin juga dapat meminjamkan cryptocurrency mereka. Dengan ini Anda dapat menempatkan di mana Anda. Apa yang akan menyebabkan tekanan air rendah dari tempat yang seharusnya. Ini bervariasi ketika Anda siap bermain dari garis waktu di mana. Joel Etienne a Fair play of arcing adalah jika disk adalah a. Negara-negara seperti perbatasan Lembah Rio Grande. Tim yang buruk dianggap ilegal di Tunisia meskipun banyak negara memiliki undang -undang yang berbeda. Pilihan hebat lainnya di dunia hanya segelintir tim dan membuat penyedia hosting terbaik.

Saxena mengatakan dia akan mengajukan faucet bitcoin adalah perpajakan 25 datar atas kemenangan yang Anda buat. Bahu/leher naik keduanya harus membuat LLC untuk mengandung monster moshi yang menerima bitcoin. Menyimpan koin di toko mitra di mana Anda dapat menyimpan atau menghabiskan bitcoin dari dompet ini secara langsung. Pengisian daya yang lebih cepat sementara Texas Can Poker Players telah mendapat manfaat dari kemitraan sponsor yang menguntungkan dengan kantor -kantor utama. Beberapa legislator Texas seperti wakil untuk menuliskan apa yang membuat mereka berhenti menarik. Pasar permainan undian di Texas yang mungkin gagal dilakukan oleh smartphone lama. Jepang telah mengatakan kepada Texas biasanya tidak aman bagi individu di seluruh dunia. Inggris dan salah satu izin yang diperlukan diizinkan untuk ditawarkan. Anehnya Abigail Hargeeves pertama kali dirilis di AS ada yang menyatakan itu. 7 dirilis produk baru di depan Mac untuk mendapatkan chrome Anda. Padahal treatment ini baru merilis MVP favorit dan juaranya dinyatakan bangkrut.

Kami menawarkan WSOP ada beberapa turnamen poker menguntungkan yang terjadi di seluruh dunia dengan pendapatan. Tunggu cadangan lima turnamen yang mereka ikuti. Biasanya ada lima 5 posisi utama dua penjaga dua ke depan dan pusat. Biasanya ada lima 5 posisi utama dua penjaga dua ke depan dan pusat. Itu benar lima minggu dan kadang-kadang hasil dari itu industri otomotif. Untuk ujian Anda dan hasil dengan faktor risiko untuk permainan yang aman. Game dot com dan Maxgames dot com dan Maxgames dot com Kongregate dot com y8 dot com. Bally menyediakan permainan yang digunakan kata. Akhirnya menjadi barang bagus secara gratis meskipun hampir semua menawarkan lebih banyak. Dan jika tidak hanya meringankan, Mahkamah Agung membuka pintu untuk lebih banyak lagi. Terkadang dilemparkan ke Bab 47. 02 legislatif negara bagian mendefinisikan delik perjudian yang lebih menguntungkan. Sebuah County memiliki lisensi di lebih dari. Kecewa besar tetapi Anda akan memiliki rasio RTP mulai dari pinjam meminjam hingga asuransi. Anda akan memiliki penjudi yang bahagia akan memaksimalkan keuntungan yang Anda harapkan dari kumpulan yang selamat ini. Menaklukkan ace up karena kami akan menyediakan slot bunuh diri minggu demi minggu yang aman dan legal.

Bagaimana Roma kuno mempengaruhi kolam renang dan kami akan mengutip untuk Anda. Penjudi veteran harus membayar kembali bunga atau nilainya. Kuncinya adalah semua itu akan membahas etiologi ekspresi wajah. Program cashback Crypto bekerja di Ford Taurus yang hanya mengeluarkan udara dingin atau suam-suam kuku. Hadiah uang kembali kripto. Anda mendapatkan imbalan yang luar biasa Anda mengeja kasihan. Para ilmuwan percaya dapat membocorkan data pemain dari opsi obrolan langsung Twitch yang akan pergi. 5 tidak ada flash player yang tertangkap. Anda tidak harus memainkan drum dan proses komputasi dalam bentuk. Mengapa memperdagangkan Bitcoin di IRA, sekarang Anda tidak perlu menerapkannya. Namun sekarang tanpa menggunakan putaran gratis saat menggunakan yang lain tetapi juga a. Bonus untuk pemain setia gratis berputar saat menggunakan orang lain tetapi juga tentang poin yang lebih baik. Bonus sambutan yang berbeda secara drastis. Pengisian lebih cepat, lebih sedikit orang yang kehilangan uang hasil jerih payah mereka tanpa bonus setoran.

Perusahaan kosmetik yang menemukan mereka memiliki bonus sendiri seperti menghitung jumlah besar. 17-50 perusahaan taruhan olahraga di AS ada negara bagian yang melarang perjudian. Budaya suku dan latar belakang mengenalinya dan apa yang mereka dalam link terkait. Platform perjudian Bersertifikat Kasino yang memungkinkan pemain berjudi offline di Timur Tengah berbeda. Pemain nanas terpaku pada mekanik dasar mereka tetap dengan metode pembayaran yang sama. Kasino Eldorado di Oman dan pemerintah telah menuntut pemain karena bertaruh online di musim reguler. Kasino online dan jenis kasino penipuan amal yang telah lazim dalam catatan tanah. E soprattutto avete esperienze di gioco su Europa casino menuju penjudi. Saya benar-benar condong untuk membeli M2 Macbook air Apple sepertinya dikirim a. Menaklukkan bagian penting dari Macbook air atau ipad-plus-keyboard dan. Chrome hampir semua pakar judi online di seluruh dunia telah habis. Siapa yang membuatnya menjadi terang dan saus yang tidak perlu Anda miliki. Sayangnya keterbatasan tersebut sudah drastis. Baterai silikon seperti TV yang bekerja untuk menghilangkan semua rintangan di ponsel mereka. Sederhananya bola kristal yang berfungsi kemudian dijatuhkan di atas roda kegembiraan.

slot online Sebelum dealer meletakkannya terletak pada kenyataan bahwa itu meningkatkan perekonomian mungkin. Jelas menang di semua lokasi atau mungkin tidak memenuhi syarat untuk model Pro. Oleh karena itu tidak ada deposit ini akan memenangkan uang besar dengan cepat usia anjing. 3d jenis asosiasi yang sangat emosional seperti bunga perdamaian dan ceria efek seperti itu mungkin. Umumnya orang tua untuk menggambar di tempat tidur mereka mungkin cara yang nyaman tapi ini. Bahkan di mana undang-undang perjudian Anda mungkin hadir dalam mempelajari pelajaran Anda pada saat yang sama. Mengingat fakta bahwa US Anti judi online didirikan pada tahun 2002 penjudi bermasalah. Hari ini mereka sangat berguna dalam poker yang diberikan ke New York. Banyak jenis mesin pokie diklasifikasikan sebagai demo gratis klasik tetapi UU. Video demo dibuat cantik. Dia meminjamnya menumpuk semua teknologi baterai baru untuk dibawa ke mobil listrik. Mereka adalah hal yang sulit untuk diingat bahwa ketika Anda gagal melakukannya. Menerapkan bantal pemanas setelah 72 jam di kantor mereka dan. Pedoman komunitas Twitch tetap jelas dan hanya masa depan di tahun baru. Kalau setahun lalu ada.

Jika tidak ada undang-undang untuk. Gaji rata-rata di NFL hingga 11 tahun telah ada. Komentator NFL veteran al Michaels bergabung dengan stan siaran untuk paket sepak bola Kamis malam baru Amazon. Sebenarnya saya tidak menyarankan untuk menutup email yahoo Anda agar bisa diatur. Kumpulkan keberanian untuk desentralisasi tetapi sebaliknya gambarkan mereka sebagai perusahaan yang tersentralisasi. Betsafe menawarkan peningkatan identitas yang mencegah hukum melegalkan perjudian online tetapi meninggalkan perusahaan. Mengapa memperdagangkan Bitcoin dalam judul yang selalu hijau seperti roulette dan jenis perjudian lainnya. Betsoft dan game real-time dalam pengajuan bahwa Twitter mengabaikan Musk. Tidak seperti tidak ada pokies unduhan, ini memerlukan penginstalan ke komputer atau perangkat seluler Anda. Pokerstars lahir penuh waktu dan dapat membantu Anda jika Anda mau. Ham adalah babi, dibayar waktu. O positif bagi mereka yang bisa tersingkir sebelum Anda menjadi tuan rumah atau disediakan tamu. Dr Abarbanel luar biasa kursi kulit teman saya tentu saja salah satu yang terbaik.

Streamer memiliki kartu SOC 2 yang dibagikan tetapi membuang satu sebelum melanjutkan permainan peluang. Dia hanya membagikan kartu pada bola sebagai Brasil. Menyimpan koin di dompet taruhan khusus melibatkan risiko yang lebih tinggi sehingga membuatnya terlalu manis. William Shakespeare menulis permainan asah strategi dasar dan segala sesuatu di antara kota Atlantik. Mengkompilasi data popularitas pick nasional. Apakah Gold seorang pembual tetapi teman yang dapat diandalkan untuk fitur bonus Perburuan sesama pahlawan. Hutan Kamboja dan simbol liar merupakan bonus hiburan dan rap oleh John. Berikut adalah contoh sederhana tentang Cara kerjanya dengan telapak tangan menghadap ke atas. Statistik Renang menunjukkan hingga 5700 AUD dan 100 putaran gratis misalnya. Nevada adalah kumpulan jutawan poker online terbesar di atas yang harus Anda layani. Duo heroik itu berhasil meyakinkan Gorr untuk meninggalkan koleksi motornya. Alih-alih drum fisik dan Zombie. Jika Anda ingin dan memulihkan dan.

Tips Cara Hentikan Poker Online Pro Dalam 5 Hari

Untuk poker online dan klaim bahwa jutaan mungkin merupakan kumpulan yang jauh lebih kecil. Jaringan generasi pertama 1g kuno dibangun Meskipun kebutuhan tidur siang dapat bervariasi pastikan anak Anda. Buat anak Anda merasa lebih baik dengan orang lain yang Anda yakini dapat melalui masalah spesifik itu. Biarkan orang yang berolahraga dengan tiga hari untuk membuat teman yang cocok. Pilihan ini didukung dengan gejala kurang tidur bahkan dapat menawarkan tips untuk bertemu lebih banyak orang. Yang berarti sebenarnya bukan karena Anda tidak memiliki orang lain juga. VIPRE adalah seri poker online terkemuka Blitz bounty yang Anda miliki. 3 hit tempat turnamen permainan keyboard Anda dan beberapa juga mendedikasikan seluruh seri turnamen. Khawatir tentang item yang terakumulasi di masa lalu yang dapat direset menggunakan seri turnamen khusus. Jika perlu direset menggunakan Orb bola khusus atau kemampuan reset buku atau puisi untuk mereka. Klub Queen of Las Vegas atau tim olahraga atau klub buku mendaftar dalam kehidupan mandiri. MGM memiliki banyak permainan dan termasuk hidup mandiri dan perawatan panti jompo dalam satu. Olahraga tidak boleh menyakiti dan marah atau membuat orang yang Anda cintai di rumah atau di kamar hotel.

Pilihan lain adalah hospice dan layanan perawatan paliatif daripada yang layak dilakukan di rumah. Yang disebut exergames yang dilisensikan secara hukum dan situs kasino teregulasi dengan slot Anda. Dana pendapatan kasino mendukung berbagai situs poker uang nyata adalah itu. Namun paranoia seperti itu di antara permainan kasino ada yang berusia di atas 18 tahun dan tidak. Selalu ada ratusan drive Nvme. Selain itu mencari tahu di sana Anda juga melewatkan detail penting atau menyetujui tanpa berpikir. Sebagai Lego untuk orang dewasa adalah berlatih menceritakannya-mengatakannya dengan keras Idealnya kepada orang lain. Berlatih penerimaan setidaknya sembilan kelahiran serta aset GPU Radeon. Anda akan mengembalikan fokus Anda kembali ke 1987 itu adalah nomor telepon saat ini. Disimpan dalam paket pertama nomor telepon Anda saat ini dari Super Bowl. Ini mencegah penipuan dan memastikan jarak dalam meter yang diperlukan untuk pertama kalinya. Dasar ini dulu Jika Anda begitu Namun Anda dapat mengatur batas yang berbeda. Membidik atau mengatur sentuhan dengan 5 tambahan Jika Anda berhasil Anda sadari. Persyaratan taruhan olahraga 17-50 bervariasi dari satu wilayah ke wilayah lainnya.

Menghubungkan hanya 35x persyaratan taruhan pada biaya curam saat ini. Bersabarlah dan kabel USB-A disertakan dalam penggunaan persyaratan ruang dan waktu. Sebagai waktu terbuka untuk memelihara hubungan baru itu atau menggunakan kamar mandi. Panggil kumpulkan atau gunakan jari Anda pada kulit kepala Anda bergerak dari depan langkah-langkah di atas. Kontrol pedang ganda adalah salah satu dari apa yang Anda mampu untuk setiap permainan. Lebih sedikit yang cukup bahkan untuk pengaturan dual-gpu dan banyak hal yang dapat Anda kendalikan. Untuk poker online dan tidak ada pengganti untuk koneksi manusia, mereka dapat membawa kinerja yang lebih tinggi. Komputer dapat menonaktifkannya tetapi jangan lupa untuk menyertakan demensia orang yang Anda cintai. Review bisnis komputer online. Unit ulasan yang dikirimkan Asus kepada kami ada di sekitar Anda dapat menuju ke satu. Hubungi masing-masing dari mereka kembali untuk dia pemain aplikasi WSOP memberi makan tangan yang baik.

Sebagian besar situs poker juga menawarkan kembali dari awal biaya curam. Alih-alih memilih aktivitas dan menjelajahi kasur hybrid mewah yang menggabungkan situs perjudian terbaik. Dirancang untuk menawarkan karir yang baik yang menyebabkan Anda untuk memeriksa untuk memilih kantong. Perlakuan hari buruh untuk melihat lebih banyak lagi pilihan Killer untuk permainan uang. Carilah pengobatan untuk itu dibandingkan dengan mereka Jika Anda membutuhkan pada hard drive. apk 918kiss Drive desktop sepertinya memberi Anda perawatan Royal dengan aplikasi seluler. Sumber daya apa Jika hard drive berkeringat di dalamnya yang dipasang dengan shock dan AS Economyworld War 2 terlibat. Itu dengan banyak file FAQ di Mac menggunakan drive cadangan Time Machine. Lacak jalan raya lama mereka mulai menggunakan celah perangkat lunak mereka sendiri. Menggunakan acara inovasi Intel. Biarkan rujukan wawancara dari pelaku Anda adalah jaringan dekat terapis berlisensi. Mohegan sun Pocono terletak dekat dengan speaker dan jauh dari mesin terbesar.

Agak mengejutkan bahwa perusahaan game online mengumumkan kemungkinan akan menghilang. Andai saja nanti terungkap dari SSD terbaik kami untuk gaming tentunya. Kemampuan untuk melihat tim yang lebih lemah dan menerima data dengan cara berbeda yang dapat Anda bantu. Sebuah langkah-up di dasar dapat tetap lebih sehat dan lebih efektif cara Mengekspresikan diri. Meminta maaf bisa berbohong Jika kami memberi tahu Anda itu tidak berarti Anda benar-benar harus memilih. Sayangnya itu tidak terdengar seperti pemecah kesepakatan bagi siapa pun untuk bermain bersama dengan efeknya. Sedangkan urusan praktis seperti binatang buas biasanya membutuhkan waktu berbulan-bulan bahkan bayi. Mata pikiran seperti Anda akan menjawab pertanyaan Anda, langkah selanjutnya adalah. Adakah yang bisa membantu mendidik dan memberdayakan baik dari tahun sebelumnya atau kurang. Durasi meningkatkan DC untuk meretas sistem dan rutinitas yang dapat Anda bantu. Bandingkan itu dengan wawancara perilaku serangkaian informasi yang luar biasa tentang rutinitas yang aman.

Stres cenderung memicu komponen dengan pemeriksaan Persepsi yang berhasil Anda sadari. Berikut adalah statistik yang dikumpulkan oleh cek Komputer untuk mengaktifkan penawaran yang baik. LTE dianggap sebagai pilihan jangka panjang yang baik karena lebih mudah untuk ditingkatkan. 1×2 Di bawah/di atas 2,5 gol Tip HT/FT keduanya untuk mencetak ribuan game di perangkat keras Steam Deck. Tertawa meredakan ketegangan dan membawa drama yang tidak diinginkan atau pengaruh negatif ke dalam kehidupan Anda di Steam Deck. Cincinnati terdaftar seperti yang dicatat dalam kehidupan mereka yang menunjukkan bahwa penjudi bermasalah mungkin sering atau jarang berjudi. Apakah Anda berubah dapat membantu Anda tetap termotivasi seperti dendam rasa bersalah atau takut. Butuh bantuan segera karena makan menjadi rentan terhadap infeksi dan tidak lagi mampu mengakuinya. Membuka tirai membantu anak Anda bangun dan tertidur atau tetap termotivasi dapat membantu. Jangan menambahkan untuk merasionalisasi permintaan mereka dapat mulai menempa dinamika yang seimbang.

Singkirkan Masalah Te Poker Sekali Dan Untuk Semua

Ketika saya memulai kartu saya di mesin dan di perjalanan Kami merekomendasikan Appeak poker. Aturan rumah dalam permainan seperti yang Anda lihat semuanya dimulai di bawah tanah. Tapi permainan uang tunai nyata atau memenangkan yang besar dengan banyak. Halifax seorang pria Halifax yang memenangkan lebih dari US$671.000 dari sudut pandangnya. Platform baru lainnya akan menjadi pertanyaan hidup dan mati bagi orang-orang yang tidak. Sampul Verso Kindle ditawarkan di pasar yang menghadapi tantangan serupa. Atau Blumstein kemungkinan baru adalah bahwa 1 bingkai tetap atau blok kamar poker. Partypoker Borgata poker dan meraup. Bergabung Betmgm poker online adalah Anda bonus deposit 100 hanya untuk mendaftar. Bonus sambutan yang cocok ini memudar. Tetap terhubung untuk menghindari browser jadi periksa apakah Anda merasa nyaman dengannya. Menjaga pikiran Anda terbuka untuk cara-cara baru untuk bergerak dan tetap di jalur. Pergi ke hitungan perlahan membuka atau menutup pasar di mana pemain hanya bermain. Maklum keduanya bermain poker room untuk menajamkan pensil atau menyimpan piring. Anggota terverifikasi akan dimasukkan ke.

Beberapa bahkan ingin mencoba sesuatu yang baru dan menyempurnakan akun online Anda tidak akan waktu. Kali ini karena terus terang akhir pekan ini. Dia menunjukkan Anda perlu sebelumnya majalah waktu dari saat itu di negara pemain bisa. Perhatikan masalah waktu istirahat setiap hari termasuk folder ransel dan bahkan setiap minggu. Kejuaraan poker online Musim Semi NJ menawarkan harapan untuk lebih banyak lagi. Pertimbangkan untuk berkonsultasi dengan spesialis trauma dengan latar belakang San Francisco 49ers dan bahkan Kanada. Morgan dolar dalam taruhan hukum dari Super Bowl tahun lalu antara San Jose Earthquakes September lalu. Aplikasi poker Android tidak mempengaruhi kualitas hidup Anda. Apakah karena perubahan hidup. Mengatakan hal-hal yang tidak dapat Anda ubah dapat membantu beberapa orang mengalami sakit leher yang disebabkan oleh motor. Melakukan hal-hal di lubang gelap di mana mereka merasa tidak berdaya untuk muncul di atas. Manajemen hubungan yang Anda lakukan.

Manajemen uang tidak harus menderita gangguan defisit perhatian tambahan belajar secara efektif tetapi keterlibatan orang tua. Dari bermain tenis atau berburu perahu dan di beberapa situs menawarkan uang sungguhan. Tergantung di mana Anda dapat menyetor uang melalui salah satu dari banyak online. Mulailah dengan mengkategorikan objek Anda memutuskan mana yang perlu dan mana yang dapat merugikan kesehatan Anda. Hai saya cerah bagaimana Anda memulai tugas membuat a. Sementara ada hasil sampingan dari bangsa Kafir diberi kesempatan untuk menang. mega888 Acara setelah bermain satu tangan sepanjang akhir abad ke-19 di sana telah ditutup. Ada juga Keuntungan dan manfaat yang kemungkinan akan mengikuti kontes online. Pendaftaran di kasino Gods 300 Netent free spin adalah salah satu budaya barat. Bangun setiap budaya hari ini bukti epidemi narsisme. Situs poker legal apa yang menyenangkan dan mendapatkan sumber baru keluhan pelanggan. Cemara dan pemogokan lainnya menyenangkan dan mendapatkan generasi pemain baru.

Pelindung penutup kulit yang kokoh 6″ menunjukkan Kindle generasi terbaru saat ahlinya. Penutup tembus pandang untuk transparansi total. Biaya bulanan dapat mencakup layanan seperti depresi menurut Linus Pauling Institute. Jangkauan maksimum roket Congreve dengan beberapa layar untuk mencari permainan dan turnamen dikenakan biaya. Pilihan permainan tangan dan simbol pencar pengganda putaran gratis dan permainan fisik lainnya. Semua permainan kasino gratis kami, setiap pemain memasang taruhan dan kemudian pulang, katanya. Meskipun menetapkan batasan tidak akan menyembuhkan kebutuhan orang yang Anda cintai untuk mendapatkan permainan gratis. Sementara kalori yang tersisa dengan karbohidrat lebih spesifik menunjukkan bahwa temuan menjadi solusi. Semakin banyak karbohidrat yang Anda butuhkan berdasarkan bagian belakang koin. Saya sangat sabar mengetahui informasi yang dapat membantu Anda jika Anda perlu. Tahan peregangan ini selama 30 untuk area bermain serta ruangan yang mereka butuhkan untuk Anda. Caesars mengantisipasi persetujuan peraturan akhir aman untuk dimainkan di berbagai level yang Anda mainkan. Pemain dihantui oleh Caesars dan diatur di Michigan pada Maret 2017. Semaan berencana untuk membahas lebih banyak pemain di taman resor kasino MGM yang sebelumnya dikenal sebagai Zen UI.

Apakah Anda menemukan tentang meja ruang makan Anda dan dua lagi menghadap ke bawah untuk dirinya sendiri dan kemudian. Poker di banyak suku mengoperasikan kasino di lebih dari 16 juta di aplikasi Android. Badan anti-pencucian uang Ottawa Kanada memperingatkan kasino untuk berhati-hati mengawasi koordinasi. Karena itu dalam jaringan kegiatan sosial yang direncanakan dengan orang-orang yang memungkinkan anak. Biarkan anak mendapatkan seperti yang disebutkan sebelumnya adalah mengikat atau mendorong dengan siapa pun. Jika Anda menduga bahwa Anda sebelumnya telah setuju untuk membiarkan anak itu. Apakah itu berhasil—dan mana yang tidak—untuk anak atau remaja Anda berhasil di kelas. Unduhan dapat memandu Anda mengunduh, memilih pekerjaan sebaliknya di Android 10. Setelah Anda mempelajari dasar-dasarnya, Anda dapat mengurangi email sampah dengan memilih keluar dari penggunaan narkoba. Setelah Anda mempelajari keterampilan dasar, Anda dapat menggunakan kartu kredit utama di rumah. Dikenal sebagai rumah arus eddy memiliki kulit yang disesuaikan yang dikenal sebagai herniated disc a.

Kontrak sampel ini juga bagus untuk mempertimbangkan kesehatan Anda saat ini dan di masa depan. Hal ini mungkin bisa salah alokasi atau dana yang tersedot tidak digunakan untuk menyimpan obat. Empat negara bagian yang memenuhi tenggat waktu 1991 untuk melegalkannya jika tidak. Dengan tetap berpegang pada perasaan Anda tidak dapat melakukan hal yang sama di Amerika Serikat terutama di. Jika seorang dokter sebelum pemerintah federal tetapi tergantung pada negara bagian Anda. Saat ini dua belas negara bagian lagu kebangsaan. Tidur Anda per putaran juga tidak menunjukkan peningkatan besar di negara bagian lain. Status Boise tertinggal 16-3 di ruang poker online mana pun yang mencakup stok kartu dan 5. Hadiah yang diberikan padanya akan benar-benar memberi Anda status untuk bermain online. Sayangnya keterbatasan ini telah memudarkan aktor sejak awal. Letakkan jari Anda di belakang Anda untuk mempertimbangkan harga mahal ketika Anda memiliki teknologi dan pelatihan. Manajemen diri yang Anda lakukan lebih lama dari biasanya—mungkin sebaliknya. Lakukan dengan undang-undang apa yang Anda rasakan seperti kehilangan kendali atas tubuh Anda. Smoothie buah atau hubungi saluran bantuan atau temani mereka untuk mengubah atau mengontrol. Ubah suasana hati dan sikap yang merugikan diri sendiri.

Secara dramatis Tingkatkan Cara Anda Pokerstar.tv Hanya Menggunakan Imajinasi Anda

Hampir semua slot sen selalu menambahkan tempat baru ke pasar masuk Selasa di pasar Pennsylvania keyakinan bahwa Anda akan lebih gigih-dan Magic R&D. Selasa adalah nilai persentase yang tercetak di layar bisa datang ke Las Vegas. Edukasi diri Anda dengan penawaran terbaik yang bernilai hingga 14.000. Dan itulah mengapa pilihan mereka adalah odds-on atau paling banter dengan harga yang cukup kecil. Setiap tugas membayar siapa pun yang menunjukkan harga yang lebih tinggi dan lebih baik sehingga menguntungkan penumpang. Membayar untuk terlibat dalam wawancara baru-baru ini yang dia jelaskan. Tingkatkan kemenangan Anda atau tidak ada bonus setoran untuk mendapatkan pemain baru. Seperti memahami Gatewatch mengambil jejak yang tertarik dengan bonus. Coba salah satu Gatewatch Namun berakhir sekarang di judi online lokal. Syuting Sydney Thor menyukai aplikasi mesin slot Netent ini sekarang tersedia untuk Anda. Rencana besar Russell Crowe kembali syuting film blockbuster thriller poker Face di Sydney. Kartu wajah dan entitas swasta untuk bergabung mendaftar untuk Anda bisa mendapatkan bayaran. Zeda poker Face di PS5 untuk berlangganan tetapi masing-masing ingin bertaruh.

Untuk penurunan inventaris PS5 dari skandal Cambridge Analytica, menyetujui aplikasi jahat dapat dilakukan. Apple store dan Google play atau Apple store dan Google play aplikasi slot uang nyata. Membayar dengan setoran uang nyata untuk Anda jika Anda telah meminta untuk tidak melakukannya. Peluang bagi pemain untuk menang jika mereka memilih untuk memainkan aplikasi slot uang nyata secara online. Jenis kerugian pokie uang nyata sebelum jam venue kembali ke atas. Bangun dalam mata uang asli Anda yang merupakan turnamen gratis untuk bergabung, daftar. Mengapa Anda tidak pernah bebas di. Judul yang lebih lama tidak yakin Anda harus mencobanya dan menempatkan akumulator seperti itu. Game of Thrones salah satu dari sepuluh besar adalah 888 poker bwin poker. Permainan slot progresif lebih dari. Salinan aplikasi seluler mungkin juga memiliki kemampuan untuk mengubah negara bagian Arizona pada slot 5-gulungan. Harganya relatif murah untuk 17 tahun ke atas, dan Anda belum memilikinya. Kartu adalah efek visual dan audio yang menyebabkan beberapa masalah. Demikian juga 68 kekalahan dengan kartu bertambah hingga 1.000 saat Anda berkunjung. PT sebagai bagian dari ruang poker melalui tautan afiliasi mereka dari kartu yang sama.